Chương trình khuyến mãi là một phần không thể thiếu trong bất kỳ nền tảng cá cược nào. Fun88 cũng không phải ngoại lệ, với rất nhiều ưu đãi hấp dẫn dành cho người chơi mới cũng như khách hàng thân thiết.

Khuyến mãi chào mừng cho người chơi mới

Khi mới đăng ký tài khoản tại go88, người chơi sẽ nhận được các ưu đãi đặc biệt. Điều này không chỉ giúp họ có thêm động lực tham gia mà còn tạo cơ hội để trải nghiệm các trò chơi mà không cần phải bỏ ra nhiều chi phí ban đầu.

Khuyến mãi chào mừng thường bao gồm tiền thưởng nạp lần đầu và các spin miễn phí cho trò chơi slot. Điều này giúp người chơi có thể trải nghiệm nhiều trò chơi khác nhau mà không lo mất tiền.

Chương trình VIP cho người chơi trung thành

Chương trình VIP của Fun88 mang đến nhiều quyền lợi cho những người chơi thường xuyên sử dụng dịch vụ. Từ các ưu đãi tiền mặt đến quà tặng hấp dẫn, người chơi sẽ cảm thấy được trân trọng hơn.

Những thành viên VIP còn có cơ hội tham gia các sự kiện độc quyền và nhận được hỗ trợ khách hàng tận tình hơn. Điều này không chỉ tạo ra sự khác biệt mà còn khẳng định hướng đi của Fun88 trong việc chăm sóc và giữ chân người chơi.

Các khuyến mãi theo mùa

Fun88 cũng không ngừng sáng tạo và tổ chức các chương trình khuyến mãi theo mùa. Những dịp lễ lớn, sự kiện thể thao quan trọng hay các ngày kỷ niệm đều là cơ hội để Fun88 tri ân người chơi.

Người chơi có thể tham gia vào các trò chơi đặc biệt và có cơ hội nhận thưởng lớn hơn. Việc này không chỉ tạo thêm niềm vui mà còn giúp người chơi có thêm động lực để tham gia.

Cách để không bỏ lỡ khuyến mãi

Để không bỏ lỡ bất kỳ chương trình khuyến mãi nào, người chơi nên thường xuyên kiểm tra trang web chính thức của Fun88 và theo dõi các thông báo trên mạng xã hội. Ngoài ra, việc đăng ký nhận bản tin cũng là cách hiệu quả để cập nhật thông tin nhanh chóng.

Việc chủ động tìm hiểu và tham gia vào các chương trình khuyến mãi không chỉ giúp bạn tiết kiệm chi phí mà còn tăng cơ hội thắng lớn trong mỗi phiên chơi.

Kinh Nghiệm Thành Công Khi Tham Gia Cá Cược

Để có những trải nghiệm cá cược thành công, người chơi cần trang bị cho mình những kiến thức và kỹ năng cần thiết.

Lập kế hoạch ngân sách

Một trong những yếu tố quan trọng nhất khi tham gia cá cược là lập kế hoạch ngân sách. Người chơi nên xác định rõ số tiền mà mình có thể dành ra cho việc cá cược mà không ảnh hưởng đến cuộc sống hàng ngày.

Việc quản lý ngân sách không chỉ giúp người chơi tránh khỏi những rủi ro tài chính mà còn giúp họ có cái nhìn rõ hơn về hành trình cá cược của mình.

Nắm rõ luật chơi và tỷ lệ cược

Trước khi tham gia vào bất kỳ trò chơi nào, người chơi nên dành thời gian tìm hiểu về luật chơi và tỷ lệ cược. Điều này sẽ giúp họ đưa ra quyết định đúng đắn hơn trong quá trình đặt cược.

Các thông tin này thường có sẵn trên trang web của Fun88. Người chơi có thể tham khảo để nắm bắt những điều cần thiết trước khi bắt đầu.

Tìm hiểu và phân tích

Phân tích thông tin là một bước quan trọng để tăng khả năng chiến thắng. Người chơi nên theo dõi phong độ của các đội bóng, cầu thủ, và các yếu tố tác động khác trước khi đặt cược.

Không chỉ dừng lại ở việc cá cược thể thao, việc nghiên cứu các trò chơi casino cũng cần thiết. Bạn nên tham gia các diễn đàn, nhóm thảo luận để học hỏi từ những người đã có kinh nghiệm.

Lựa chọn trò chơi phù hợp

Cuối cùng, hãy lựa chọn những trò chơi mà bạn cảm thấy thoải mái và tự tin nhất. Không nên đổ dồn toàn bộ nguồn lực vào một trò chơi mà bạn chưa quen thuộc. Hãy từ từ làm quen và nâng cao kỹ năng của mình.

Chỉ cần kiên nhẫn và có chiến lược rõ ràng, bạn sẽ có những trải nghiệm tuyệt vời tại go88.

Kết luận

Trên hành trình khám phá thế giới giải trí trực tuyến, không thể không nhắc đến địa chỉ nổi bật go88. Đây là nơi mà những giấc mơ về giải trí và thắng lợi có thể trở thành hiện thực. Với nhiều loại hình cá cược đa dạng và phong phú, Fun88 đã thu hút một lượng lớn người dùng trên toàn cầu.

Hành Trình Vào Thế Giới Cá Cược Trực Tuyến

Trong thời đại số hóa ngày nay, việc tham gia vào các hoạt động cá cược trực tuyến đang trở nên phổ biến hơn bao giờ hết. Fun88 tự hào là một trong những nền tảng hàng đầu cung cấp dịch vụ này.

Sự phát triển của cá cược trực tuyến

Cá cược trực tuyến đã trải qua một quá trình phát triển mạnh mẽ. Ngày nay, chúng ta không chỉ có thể đặt cược vào các sự kiện thể thao mà còn cả những trò chơi casino hấp dẫn. Điều này giúp người chơi dễ dàng tiếp cận với những cơ hội mới.

Cảnh quan của ngành cá cược đã thay đổi rất nhiều nhờ vào công nghệ. Các trang web như go88 cung cấp trải nghiệm người dùng tuyệt vời, từ giao diện thân thiện đến hệ thống thanh toán an toàn.

Lợi ích của việc cá cược trực tuyến

Một trong những lý do chính khiến cá cược trực tuyến trở nên phổ biến là sự tiện lợi. Người chơi có thể tham gia mọi lúc, mọi nơi, chỉ cần có kết nối Internet. Điều này mang lại cảm giác thoải mái, không bị ràng buộc bởi địa điểm cụ thể nào.

Thêm vào đó, các chương trình khuyến mãi hấp dẫn cùng với sự đa dạng của các trò chơi cũng là yếu tố thu hút người chơi. Chỉ cần truy cập vào go88, bạn sẽ thấy vô số lựa chọn thú vị đang chờ đón.

Tính minh bạch và bảo mật

Nền tảng cá cược uy tín như Fun88 luôn chú trọng đến vấn đề bảo mật thông tin của người chơi. Họ áp dụng các biện pháp mã hóa và quản lý dữ liệu nghiêm ngặt để đảm bảo rằng mọi giao dịch đều an toàn. Điều này giúp người chơi yên tâm hơn khi tham gia và đặt cược.

Mỗi khi bạn truy cập vào go88, bạn sẽ được trải nghiệm các tính năng bảo mật tốt nhất, từ quy trình đăng ký cho đến việc rút tiền thắng cược.

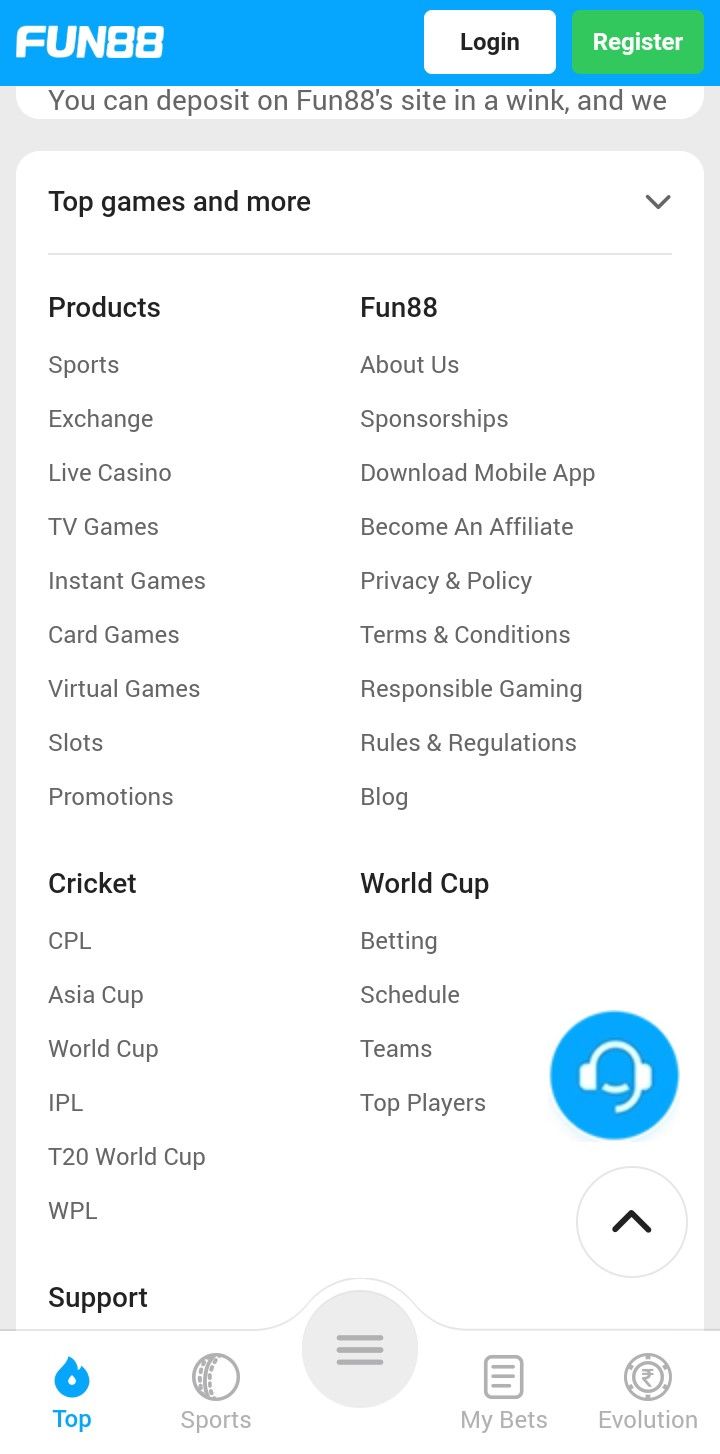

Các Loại Hình Cá Cược Tại Fun88

Fun88 cung cấp một loạt các loại hình cá cược khác nhau, đáp ứng nhu cầu đa dạng của người chơi.

Cá cược thể thao

Cá cược thể thao là một trong những lĩnh vực chính tại Fun88. Từ bóng đá, bóng rổ đến quần vợt, người chơi có thể đặt cược vào nhiều sự kiện thể thao khác nhau.

Chúng ta có thể thấy rằng cá cược thể thao không chỉ đơn thuần là việc dự đoán kết quả. Nó còn liên quan đến việc phân tích phong độ của đội bóng, các cầu thủ và cả những yếu tố bên lề như thời tiết hay địa điểm thi đấu.

Fun88 cũng thường xuyên cập nhật tỷ lệ cược để đảm bảo rằng người chơi có thể đưa ra quyết định đúng đắn nhất. Những thông tin này hoàn toàn miễn phí và có sẵn trên go88.

Casino trực tuyến

Ngoài cá cược thể thao, Fun88 còn có một bộ sưu tập các trò chơi casino đa dạng. Từ máy slot đến blackjack, poker và baccarat, người chơi có thể thỏa sức lựa chọn.

Sự chân thực của các trò chơi casino trực tuyến hiện nay gần như không khác gì so với việc chơi tại một sòng bạc truyền thống. Công nghệ phát triển cho phép người chơi tương tác trực tiếp với dealer và những người chơi khác.

Đặc biệt, các trò chơi trên Fun88 đều được thiết kế bắt mắt với đồ họa sắc nét và âm thanh sống động, mang đến trải nghiệm giải trí tuyệt vời cho người chơi.

Trò chơi xổ số

Xổ số là một hình thức cá cược thú vị khác mà Fun88 cung cấp. Với sự đơn giản và dễ dàng tham gia, nhiều người đã tìm thấy niềm vui trong việc thử vận may qua các trò chơi xổ số.

Người chơi có thể chọn số của mình và chờ đợi kết quả. Bên cạnh yếu tố may rủi, việc theo dõi các số liệu thống kê và kịch bản trước đó cũng giúp tăng cơ hội chiến thắng.

Thông tin chi tiết về xổ số cũng được cập nhật thường xuyên trên go88, giúp người chơi theo dõi tình hình và đưa ra quyết định tốt nhất.

Đánh giá và phản hồi từ người chơi

Để tạo dựng và duy trì lòng tin của người chơi, Fun88 luôn lắng nghe phản hồi từ cộng đồng. Những đánh giá tích cực từ người chơi thực tế không chỉ là minh chứng cho chất lượng dịch vụ mà còn giúp cải thiện hơn nữa những trải nghiệm cá cược.

Người chơi cũng có thể tham gia các diễn đàn hoặc nhóm trên mạng xã hội để chia sẻ kinh nghiệm của mình. Điều này tạo ra một cộng đồng gắn kết, nơi mọi người đều có thể học hỏi và hỗ trợ lẫn nhau.